Once upon a time, in a bustling city where rents skyrocketed and dreams of homeownership seemed far-fetched, a new trend emerged. It was a sanctuary for those craving a nest they could truly call their own without breaking the bank. These were not just any homes; they were wallet-friendly homes with low assessments, ideal for urban dwellers who longed for affordable sanctuaries in a vibrant metropolis. For young families, artists, and professionals alike, this was a golden opportunity to seize their dream home and plant roots.

Read Now : Wallet-friendly City Living Designs

Why Wallet-Friendly Homes Are a Game-Changer

Let’s face it, buying a house ain’t cheap, and with all those taxes and assessments looming, it can feel like you’re tossing money into a pit. But what if you could snag a place that doesn’t drain your bank account every month? Enter wallet-friendly homes with low assessments. These gems are all about cutting costs without cutting corners. Imagine having enough left over for some weekend fun or those killer decor ideas you’ve pinned for years. Low assessments mean more cash in hand, letting you live your best life with ease.

These homes are perfect for those who want to live large without the corresponding price tag. Young folks, especially, are all about that work-life balance, and wallet-friendly homes with low assessments provide just that. With a lower financial commitment, there’s more time and money for the things that truly matter. Whether it’s hiking with friends, hitting up a new restaurant, or just chilling at home with a Netflix binge, life is just smoother.

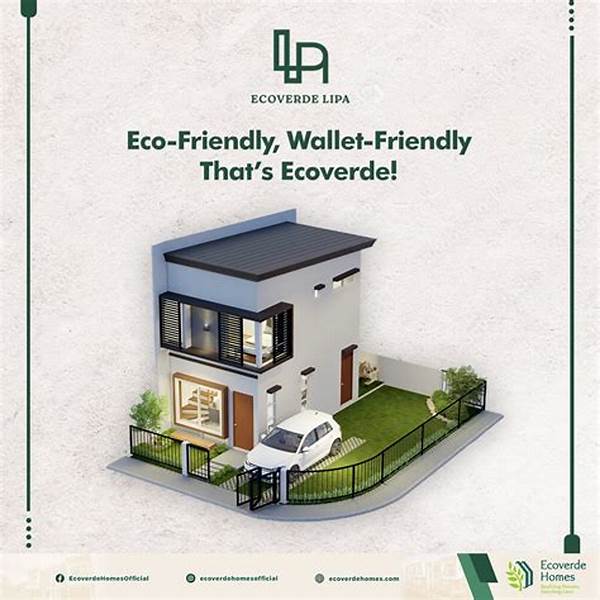

In the world of real estate, having low assessments doesn’t mean scrimping on quality. Wallet-friendly homes with low assessments can still be modern, stylish, and convenient. Thanks to savvy developers and a keen eye on eco-friendly solutions, it’s entirely possible to own a house that’s both easy on your wallet and the environment. So go on, step into your new pad and toss away those financial stress blues.

The Benefits of Low Assessments

1. Mo’ Money, Less Problems: Lower assessments mean you keep more of your hard-earned cash. Wallet-friendly homes with low assessments help you stretch that dollar further and live a richer life.

2. Budget-Friendly Livin’: Staying within a budget without sacrificing dreams? That’s what wallet-friendly homes with low assessments offer. It’s the best of both worlds!

3. Stress-Free Bills: Forget juggling high bills each month. These homes give you the pals, not the pains of unexpected charges.

4. Epic Resale Value: When keeping up with the Joneses isn’t your style, homes with low assessments still hold their worth in the market.

5. Less Financial Burden: Laugh in the face of hefty yearly property payments. With wallet-friendly homes with low assessments, those stresses are a thing of the past.

Savvy Living in Wallet-Friendly Homes

Finding wallet-friendly homes with low assessments can sometimes feel like searching for a needle in a haystack. The real trick, though, is knowing where to look and what to watch out for. Areas that are a bit under-the-radar tend to have these hidden treasures, just waiting for someone who can spot a killer deal. They’re often in up-and-coming neighborhoods where the vibe is just blossoming, giving you a chance to be part of a community as it grows.

Read Now : Nature-filled Family Retreats

Style won’t be compromised either! Wallet-friendly homes with low assessments often come with unique features that reflect the character of the neighborhood and the creativity of developers eager to offer something fresh. Open-floor plans, energy-saving designs, and low-maintenance yards are just a few reasons why so many folks are getting crazy excited about them. Homeownership shouldn’t mean living under a rock until it’s paid off. It should be a gateway to new adventures experienced from the comfort of your own slice of the pie.

When you’ve found a wallet-friendly home with low assessments, you’re not just buying property. You’re buying into a lifestyle and a sense of freedom. This freedom is just as much about financial flexibility as it is about personal expression. To truly rock that open-house tour, keep your eyes peeled for the little extras that make them one of a kind, like community gardens or close proximity to local hotspots.

How to Find These Hidden Gems

Investing in Wallet-Friendly Homes for Long-Term Gains

When investing in wallet-friendly homes with low assessments, you’re thinking long-term. These aren’t just places to crash; they’re future gold mines. People forget that a home can be an investment, one that appreciates over time while keeping your outgoings slim in the short-run. Your investment grows, and you can always upgrade or flip it once the neighborhood booms. Don’t be fooled into thinking budget-friendly means zero potential. In fact, it’s quite the opposite!

The joy of owning wallet-friendly homes with low assessments doesn’t just revolve around saving bucks; it’s about the prospects these places open up. You can reinvest the saved money elsewhere; maybe sprucing up your interior, or snagging a second property. Just think about the long game and keep your finances light while your property hefts up in value. It’s a dynamic duo that stands strong amid market fluctuations.

Long-Term Financial Security

Apart from the day-to-day savings, the true treasure lies in the long-term benefits. By owning a wallet-friendly home with low assessments, your ongoing expenses stay minimal, allowing for better allocation of resources elsewhere. This provides a cushion, a monetary safety net that enhances your net worth. The more you save, the more options you have for future endeavors, whether it’s in stocks, bonds, or further real estate.

Investing in these homes offers more than just immediate savings — it’s about securing financial stability and flexibility for the future. For individuals who prioritize economic prudence, wallet-friendly homes with low assessments are a blueprint for living sustainably while paving the way for future financial growth without the weight of hefty assessments looming over the horizon. With time, you gain not just a residence but also an investment vehicle that can provide financial dividends.