Once upon a time, there was a small-town investor named Jake. Armed with ambition but only a modest pile of savings, Jake was determined to make a splash in the world of investing. Yet, the more he dug into the vast ocean of investment opportunities, the more he realized just how tricky the waters were. With every potential fortune, there seemed to be an equal risk of misfortune. This is the world of evaluating risk-return trade-offs in small portfolios—a nail-biting dance between risk and reward that Jake was about to delve deep into.

Read Now : Custom Home Designs With Twin Master Rooms

The Great Balancing Act

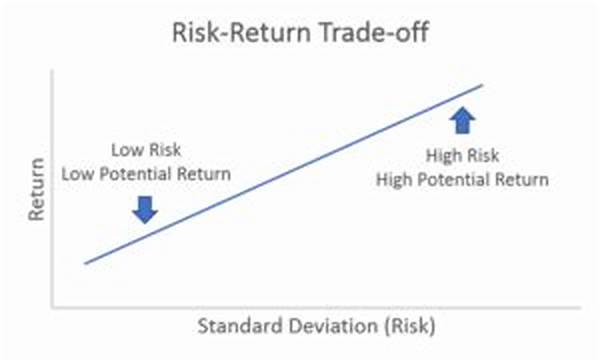

In the wild world of finance, evaluating risk-return trade-offs in small portfolios is the ultimate juggling act. Imagine having only a handful of eggs and a pretty shaky basket. You gotta decide which eggs to toss in, knowing that one shaky move could spoil the whole bunch. Small portfolios often face this high-stake game because every single stock or bond you choose is magnified in its impact.

Now, picture our pal Jake, sitting at his dining table, surrounded by stacks of financial reports and market analysis. Every choice carried a weight—buy too much of one stock, and he risks sinking his entire ship if the market sneezes the wrong way. But play it too safe, and he might never taste the sweet fruit of a solid return. Evaluating risk-return trade-offs in small portfolios requires balancing like a tightrope walker, each step calculated with intense precision.

Over time, Jake learned to become a master of this art. He figured that diversification, while perhaps less thrilling, was a smart play. With insights on market trends and a knack for gut instinct, Jake started weaving together a portfolio that was less about swinging for the fences and more about steady climbs. The game of evaluating risk-return trade-offs in small portfolios had become his chosen arena, and he was getting darn good at it.

The Slang of Trade-Off Choices

1. When it comes to evaluating risk-return trade-offs in small portfolios, you gotta pick your poison carefully. It’s like deciding between a rock and a hard place.

2. Think of evaluating risk-return trade-offs in small portfolios as a seesaw game where you’re the fulcrum struggling to keep things even.

3. For real, evaluating risk-return trade-offs in small portfolios is like betting on a NASCAR race; it’s fast, furious, and full of twists and turns.

4. Wanna know the score? Evaluating risk-return trade-offs in small portfolios is like playing poker with fate. Lay down your cards, hope for aces.

5. In the game of evaluating risk-return trade-offs in small portfolios, you gotta act like a cat landing on its feet no matter the fall.

Riding the Portfolio Rollercoaster

Diving into evaluating risk-return trade-offs in small portfolios is a ride you’re not likely to forget. It’s a rollercoaster, a wild chase, and a labyrinth of choices unfurling at dizzying speeds. As Jake would tell ya, it’s all about finding that sweet spot where risk doesn’t overshadow potential gains. Small portfolios mean every asset counts—it’s money chess with high stakes. You gotta be nimble, ready to pivot at a moment’s notice. Imagine standing on quicksand—move too fast, and you sink; too slow, and you’re stuck.

In the heart of evaluating risk-return trade-offs in small portfolios is the core principle of survival and smart moves. Jake’s journey showcases the importance of mixing caution with flair, playing the long game while keeping a finger on the pulse of changing markets. He learned that success doesn’t just come from luck but from being savvy, resourceful, and patient. It’s a dance where every step is crucial, and missing a beat could mean missing a chance at growth.

Steering Through Investment Choices

Imagine you’re on a road trip without a map, driving through a maze of endless possibilities—that’s kinda like evaluating risk-return trade-offs in small portfolios. Here are ten not-so-boring truths to guide you on this financial highway:

1. You got limited gas, so each pit stop counts. Evaluating risk-return trade-offs in small portfolios means choosing wisely where to park your cash.

2. Watch out for roadblocks. In evaluating risk-return trade-offs in small portfolios, sudden bumps can make or break your journey.

3. Diversify or detour—take multiple routes to your financial destination.

4. Stay cool; the market funky-dances all the time.

5. Always have a backup plan or spare tire for your portfolio.

Read Now : Space-efficient Furniture For Tiny Apartments

6. Keep your eyes peeled for hidden boons or investing oases.

7. Every portfolio has its weight—light enough to fly but heavy enough to stay grounded.

8. Advice from seasoned travelers (or investors) is gold.

9. Patience ain’t just a virtue; it’s a survival skill.

10. Chase moments, not just money. At the end of evaluating risk-return trade-offs in small portfolios, it’s about being wise enough to know when to switch gears.

The Heartbeat of Small Portfolios

Evaluating risk-return trade-offs in small portfolios is not just a numbers game; it’s a fierce dance of instinct meeting intellect. Financial rookies and savvy investors alike get swept by its allure, each choice echoing with what-ifs and oh-nos. Small portfolios have their own rhythm, a heartbeat defined by each asset’s pulse within it. Like a mesmerizing rhythm, this beat of decision-making sneaks up, whispering and sometimes hollering its presence, reminding you of the stakes.

Each tick of the clock heightens awareness of potential risks lurking around, ready to pounce on oblivion. Mistakes aren’t easily brushed off when your room to maneuver is limited. Yet, there’s excitement in that challenge—an adrenaline rush from navigating uncertainty. As Jake discovered, these trade-offs aren’t merely about risk or return. It’s about sculpting a masterpiece from seemingly ordinary financial blocks.

Evaluating risk-return trade-offs in small portfolios becomes a lived experience, a narrative of learning curves, redemption arcs, and moments of epiphany when that risky call turns into a triumphant victory. For all its volatility and tension, this investment art is where lessons transform into narratives, and portfolios become stories told through each chosen asset.

Navigating Market Highs and Lows

Small portfolios often feel like a boat bobbing in rough seas—vulnerable yet resilient. Evaluating risk-return trade-offs in small portfolios is like being the captain of such a boat. Even on choppy waters, it’s steering through strategic foresight. The highs are dazzling, the lows steep, but both are part of the journey.

Each stock movement sends waves rippling through the entire portfolio fabric. Yet, with gritty determination and savvy insight, pitfalls morph into stepping stones. Each market swing demands a quick hand and flexible strategy, ensuring no storm lands the knockout punch. Here, clear-headedness paired with dexterous action determines who sinks or sails.

Evaluating risk-return trade-offs in small portfolios demands a learning spirit, for the market is a ceaseless teacher. Shaped by daily lessons, the investor transforms challenges into experiences, approaching each decision as a sculptor tackles a fresh block of marble. Patience, resilience, and a keen eye—the trifecta of navigating this sea while the horizon of potential possibilities stretches boundlessly.

The Final Word

After weaving through towers of data, enigmatic charts, and layers of tension, where does that leave us? Evaluating risk-return trade-offs in small portfolios is no mere task—it’s a rite of passage for any dream-chasing investor. The intimate, hands-on journey with our stalwart Jake, serves a mini-guide illuminating paths draped in caution, initiative, and adaptation.

It’s a reminder that even small players can make big waves. Evaluating risk-return trade-offs in small portfolios levels the investment playing field, subtly echoing the essence of making the most of the cards in hand. As one dives into this thrilling conundrum, it’s essential to feel the pulse of your portfolio, listen as it converse with market dynamics, and remember each decision penned sketches a chapter in the grand investment story.

Evaluating risk-return trade-offs in small portfolios reveals the framework wherein dreams and practicality join forces—no small feat in our bustling fiscal world. Whether you’re gearing up like Jake or a veteran reorienting your compass, know your portfolio narrates distinct adventures—a story as diverse as the market itself, waiting to be told.