Once upon a time in a bustling city, Jane and Mike were on the hunt for a new place they could call home. Not just any home, but a cozy townhouse nestled in a neighborhood with tree-lined streets and a sense of community. But, before they could pop the champagne and move in, they had to face the labyrinth of evaluating costs for a townhouse purchase. It wasn’t just about finding a gorgeous spot; it was about diving deep into the numbers and untangling the web of expenses that came with it. Jane and Mike knew they were in for an adventure, and they were ready to tackle it head-on. With a mix of excitement and nervous anticipation, they embarked on their journey, determined to uncover every financial detail hiding under that charming façade.

Read Now : Evaluating Neighborhood Investment Potential

Unpacking the Costs

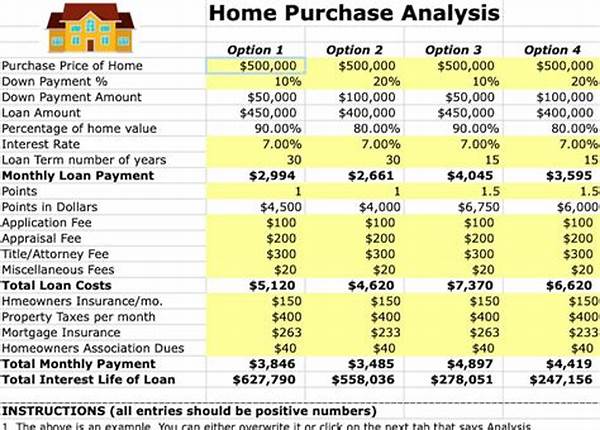

When it comes to evaluating costs for a townhouse purchase, one needs to be both a sleuth and a mathematician. Jane and Mike soon realized that the price tag on the property was just the tip of the iceberg. Lurking beneath were various hidden expenses that they had to take into account or risk sinking their financial ship. First up, they tackled the down payment, which meant dipping into their savings but feeling closer to ownership. The couple then pondered the mortgage rates, navigating financial advisor consultations, and grasping terms like “fixed-rate” and “adjustable-rate” with new-found fluency.

Moreover, they discovered that property taxes and homeowners association (HOA) fees were regular guests in their monthly budget. It was time to kick their budgeting skills up a notch. As Jane and Mike jotted down these essential details, they began understanding why evaluating costs for a townhouse purchase was such a crucial part of the buying process. With every dollar accounted for, they felt more empowered, steering their home-search ship with newfound confidence.

Their journey didn’t stop there, though. Other mysterious figures like closing costs — those elusive fees that snuck up at the end — and potential maintenance costs for unexpected repairs made their presence known. Despite the occasional head-scratcher, Jane and Mike felt prepared, and each lesson was a step toward adulting—homeowner style.

The Nitty-Gritty of Budgeting

1. Finding the right crib ain’t just about vibes, bro. It means getting down and dirty with the deets when evaluating costs for a townhouse purchase. You gotta be Sherlock and the spreadsheet king all at once.

2. When eyeballin’ those price tags, don’t forget the sneaky lil’ fellas like taxes and insurance. Evaluating costs for a townhouse purchase means checkin’ all the pockets.

3. Mortgage rates are like the weather—always changin’ and keepin’ you on your toes. Evaluate wisely, or your wallet might just weep.

4. Closing costs can hit you like a surprise party but without the cake. Evaluating costs for a townhouse purchase ensures you ain’t caught slippin’.

5. Don’t underestimate the power of maintenance cash. Evaluating costs for a townhouse purchase means preparing for leaky pipes and other surprises.

Mastering the Art of Financial Foresight

Navigating the world of home buying is like entering an uncharted jungle – you need a map, some survival skills, and a whole lot of patience. As Jane and Mike dove deeper into evaluating costs for a townhouse purchase, they found themselves juggling numbers like circus performers on caffeine. It was no longer just about finding a killer decor scheme; it became about mastering financial foresight.

Each element they uncovered played a part in the grand play that was their future homeownership journey. Evaluating costs for a townhouse purchase involved everything from scrutinizing insurance policies to dissecting utility bills like a CSI investigator. Despite the intimidating background buzz of potential costs, Jane and Mike felt exhilarated by their growing expertise, inching ever closer to the cozy nest they yearned for.

Wallet Woes, Financial Pros: Keeping It Real

1. Puttin’ dough down upfront? It ain’t just a formality. Evaluating costs for a townhouse purchase means knowing what that deposit really means, man.

2. Pro-tip: Listen to your gut and your wallet. Big purchases need both heart and savvy, especially when you’re evaluating those townhouse numbers.

3. Let’s face it; buying is adulting on steroids. Evaluating costs for a townhouse purchase helps you dodge the rookie mistakes.

Read Now : Budget-friendly Urban Housing Market

4. HOA fees: the silent partner in your new casa. Evaluating costs for a townhouse purchase makes sure you’re hip to all the deets.

5. Don’t just skim the surface; dive into those expenses. Evaluating costs for a townhouse purchase means understanding what’s under the hood.

6. Inspectors aren’t just for crime scenes. Before cash changes hands, make sure that townhouse passes the sniff test.

7. Don’t let maintenance sneak up like a random Tuesday rain. Evaluating costs for a townhouse purchase needs that all-seeing eye.

8. Got a rainy day fund? Good. Make it a rainy house fund. Evaluating costs for a townhouse purchase includes prepping for those “oops” situations.

9. Negotiation is your best friend. Evaluating costs for a townhouse purchase demands serious haggling skills.

10. In the end, it’s about lifestyle choice and expense balance. Evaluating costs for a townhouse purchase helps you find that perfect harmony.

Navigating the Final Steps

Now, armed with their newfound knowledge, Jane and Mike are ready to make the leap from dreamers to bona fide townhouse owners. Their understanding of evaluating costs for a townhouse purchase didn’t just open their eyes to potential pitfalls; it equipped them with the tools needed to make informed choices. They’ve become masters in the art of budgeting, dissecting everything from closing costs to long-term maintenance expenses. What was once a mystery is now a well-charted course as they move towards their ultimate goal.

While on this journey, they realized that each financial hiccup they encountered was a valuable lesson in the school of life. With their finances scrutinized to the nth degree, Jane and Mike could now gently open the door to their dream home, confident and prepared for the adventures ahead. Evaluating costs for a townhouse purchase was more than just checking off a list; it became a rite of passage into the homeowner’s club.

The Takeaway

In the end, evaluating costs for a townhouse purchase taught Jane and Mike more than just how to balance their budget. This process was a crash course in patience, resilience, and prioritizing what truly mattered. Beyond the numbers and dollar signs, they delved into a deeper understanding of what it meant to invest in their future. From the exciting first visits to the nail-biting final negotiations, each step was lined with invaluable insights.

Their journey turned from daunting to empowering, and as they stepped into their new townhouse, they felt a sense of achievement like no other. Evaluating costs for a townhouse purchase was just the beginning – now they could focus on turning their new house into a home, filling it with laughter, memories, and a bright future.